If you’re not on the electoral roll, you might be surprised to hear it could affect whether or not you’re accepted for car finance.

What is the electoral roll?

The electoral roll – also known as the electoral register – is a list of all the names and addresses of people registered to vote in the UK and Northern Ireland. When you register to vote, your name, address and the electoral number is logged in the electoral roll.

The main reason for the electoral roll is to make sure only people who are eligible to vote can do so, but it’s also used for other reasons, including credit applications such as car finance.

What are the benefits of being on the electoral roll?

There are many benefits to taking five minutes to register on the electoral roll:

- It will boost your credit score and make you more attractive as a borrower.

- It means you’ll be able to have your say in UK elections or referendums.

- It helps when applying for credit for car financing, mortgages, loans, phone contracts etc.

- It helps when opening a bank account or applying for a passport.

Why does being on the electoral roll matter when getting car finance?

When it comes to car finance, being on the electoral roll could really boost your chances of being accepted. That’s because it’s an important factor in determining your credit score.

When you register to vote, your electoral details are also registered on your credit report. By registering, your score will increase and, therefore so will your chances of getting credit.

Lenders also use your electoral details on the report to confirm your identity, which in turn speeds up your application and heightens your chances of your application being accepted.

Will I get accepted for car finance if I’m not on the electoral roll?

If you’re not on the electoral roll, it doesn’t necessarily mean you won’t be accepted for car finance. It can go a long way in helping you gain approval, though.

If lenders cannot confirm your details through the electoral roll, they’ll have to confirm your identity through other methods.

This may involve more forms and proof of identity and address. It will delay your application, too, so taking the simple step of registering to vote can save a great deal of time.

Who can register on the electoral roll?

To register to vote in England and Northern Ireland, you must be aged 16 or over – or 14 in Scotland and Wales. However, this is just registering – you can’t actually vote until you’re 18.

You also must be:

- A British, Irish or qualifying Commonwealth citizen

- Living in the UK or, if abroad, have registered to vote in the last 15 years

- Not legally excluded from voting (convicted criminals, for instance)

Remember, you aren’t automatically enrolled when you change your address either. So if you have moved recently, it’s more than likely that your details won’t have updated on your credit report either, and you’ll have to re-register to vote again.

Am I on the electoral roll?

You can check if you’re registered on the electoral roll by contacting your local electoral registration office.

When thinking of applying for car finance, it’s a good idea to give your credit report the once-over, too – even if you think you’re on the electoral roll.

This way, you can make sure beforehand that all your details are up to date. If they’re not, it can seriously slow down your car finance application, so it’s best to get them rectified as soon as possible.

What happens if I can’t register to vote?

If you can’t register to vote, you can ask for a note to be added to your credit report explaining why. However, in most instances, it will take longer for applications for credit such as car finance to be accepted, and depending on the lender’s criteria, you could even be rejected.

How to get on the electoral roll

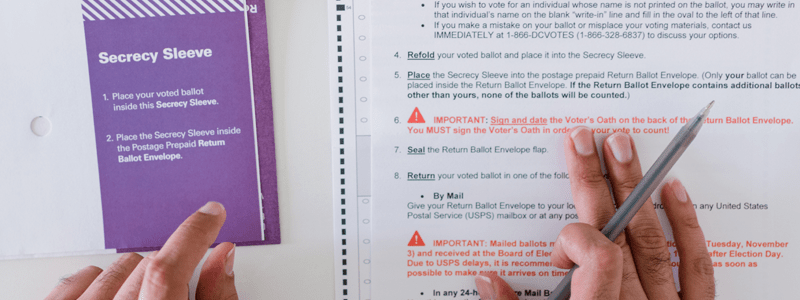

If you know your details aren’t on the electoral register, you can register either by post or online.

It’s always best to register a permanent address, as this reduces the risk of identity theft as well as helping boost your credit score.

Multiple addresses can make you look less stable to lenders, which can discourage some from giving you credit. For instance, if you’re in student halls, it might be best to register at a fixed abode such as your parent’s or grandparent’s address.

I’ve registered on the electoral roll, how long does it take to show up on my credit report?

The electoral register is updated once a month, so you should see your details on your credit report within 30 days. This does depend on the time of the month you register, though, as if it’s mid-month, it may not be included until the following month.

If you think you might need car finance in the future, the sooner you register on the electoral roll, the better.

I want car finance, but I have a poor credit score even after registering on the electoral roll

Your credit score is calculated by a number of factors – being on the electoral roll is only one of them.

When looking to take out car finance, the first step is to go through your credit report to check for any errors or things that you can put right – paying down a credit balance, for instance, or speaking to a creditor.

If you have bad credit, visit our bad credit hub to learn more about bad credit car finance.

Once you’ve done as much as you can, it’s important to find a lender who’ll assess your situation and find you the best car finance agreement.

See if you can get pre-approved for finance today with our free finance check

If you’d like to know where you stand when it comes to your eligibility for finance, our free soft credit check can let you know if you’re pre-approved for funding with one or more of the diverse panel of lenders we work with.

Applying takes two minutes and we’ll let you know in as little as an hour (if you apply during our working hours) if you’ve been pre-approved. Most importantly, though, applying won’t affect your credit score.

Get started on your journey to a new car today.

Rates from 12.9% APR. Representative APR 18.9% We are a credit broker, not a lender.

*a hard search will be performed if you decide to proceed