It doesn’t matter what type of car finance you decide to go for; getting a credit check will be an important part of the process.

Before you get accepted, finance companies want to know your credit history to give them an idea of how likely you are to repay your loan.

Your credit score isn’t the only thing they look at. Affordability and your circumstances all come into play, too. However, it’s a major factor in their decision. So, what’s a good credit score for a car loan?

What’s a good credit score for a car loan?

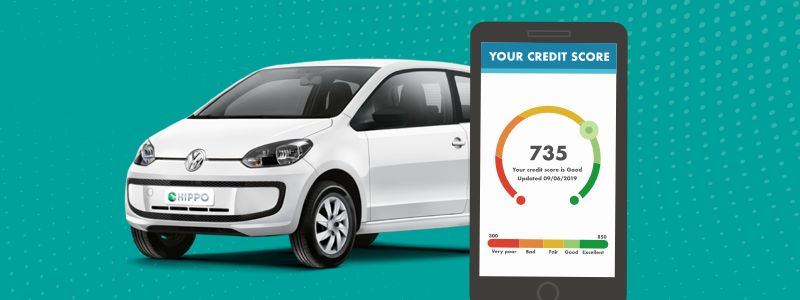

There is no one magic number that you need to hit to have a good credit score. To make it even more complicated, what counts as a good credit score varies between the different credit reference agencies, who all have their own scoring systems.

Let’s take a look at the main three credit reference agencies’ scoring systems. Experian, Equifax and TransUnion.

| Experian | Equifax | TransUnion | |

| Very poor | 0 – 560 | 0 – 279 | 0 – 550 |

| Poor | 561 – 720 | 280 – 379 | 551 – 565 |

| Fair | 721 – 880 | 380 – 419 | 566 – 603 |

| Good | 881 – 960 | 420 – 465 | 604 – 627 |

| Excellent | 961 – 999 | 466 – 700 | 628 – 710 |

Add in the fact that these aren’t the only credit reference agencies that lenders use, and you can see why it’s hard to pin down that elusive number that equals a good credit score.

If you’re thinking about applying for car finance, it’s probably a good idea to check your score with a couple of different agencies, but don’t get disheartened if the numbers don’t add up. What could give you a good score with one may only average fair with another.

How’s your credit score calculated?

It’s not only your credit score that varies from agency to agency, the way they calculate it is also different.

There are many factors that all agencies will look at within your report to determine the score they give you.

Your basic information

To assess the risk you pose as a borrower; your credit score will factor in details about you such as your age, how long you’ve been employed and how long you’ve been at your current address.

The type and amount of credit you have

There are many different types of credit available, and each has a different level of risk – a secured loan versus an unsecured loan, for instance. Your credit score will factor in how much credit you have or used to have and the type.

How long you’ve had credit for

It’s a myth that if you’ve never borrowed, you’ll have a great credit score. For you to be attractive to lenders, they need to have evidence that you can borrow money and pay it back.

This means the age of your credit history can play a part in calculating your credit score. A credit report that dates back decades will have a different level of risk than a newer one with limited history.

Patterns in your credit history

Missed payments, County Court Judgements (CCJs) and defaults all flag up as high risk indicators and will bring your score down. Similarly, a pattern on your report of making numerous applications for credit within a short period of time will also bring your score down.

How do credit scores affect car finance?

Your credit score and report is a useful tool for lenders, and they’ll always use them to determine your eligibility for car finance. It shows them how reliable you are as a borrower and gives them an idea of the risk it might pose to loan you money.

Generally speaking, the higher your credit score is, the better your chances of being accepted for car finance at the lowest interest rates.

However, it’s only part of the process, albeit a large part. Some lenders even have their own credit score, which they work out with the information you’ve submitted, your credit report and their eligibility criteria.

So spending a little time getting your credit report into shape can be one of the best things you can do before applying for car finance.

Read: What is a credit score and how does it affect a car finance application?

How can you improve your credit score?

You’ve checked your credit score with a few credit agencies and have decided it could be better. The good news is that there are several things you can do to increase your score and better your chances of getting car finance.

1. Register on the electoral roll

This is by far the easiest step to improve your score. By making sure you’re on the electoral roll, finance companies will be able to confirm your identity.

2. Keep on track

If you’re behind on any payments, bring them up to date. Make sure you pay your accounts on time and, if possible, in full every month.

3. Check for mistakes on your report

Even a misspelled address can affect your score.

4. Keep credit utilisation low

This is the percentage of credit you use. So, if you have a limit of £3,000 on a credit card and have used £1,500 of it, your credit utilisation would be 50%. Pay off some of your balance, and your score should go up.

5. Close accounts you no longer use

Conversely, if you have a lot of credit that you’re not using, it can harm your score as lenders will think you don’t need or can’t handle any more.

6. Manage your debt

In an ideal world, you’d pay off your debt before applying for new credit. However, it’s not always realistic, but the more you can pay off, the better your score will be.

7. Are you linked to another person?

Check your report to see if a spouse, family member or even housemate’s poor credit rating is bringing yours down.

Will I get car finance with a poor credit score?

If you don’t have a good financial history, it can bring your credit score down and make it more difficult to get car finance. But it’s not impossible.

At Hippo Motor Finance, we know that you’re more than just a credit score, so take your individual circumstances into account when helping you find the right kind of car finance for you.

We only ever use soft search in the first instance to check to see if you’ll be accepted. That way, there’s no negative impact on your credit file, and we’ll never damage your credit score.

Check now to see if you will be accepted for car finance with our soft credit search. It’s quick, simple, and free.